ETH Price Prediction: Bullish Trajectory Supported by Technical Strength and Institutional Demand

#ETH

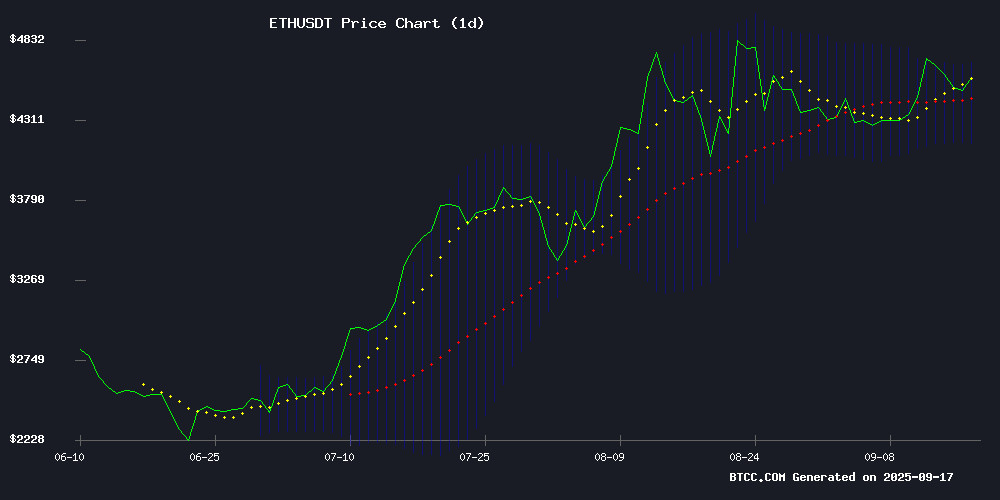

- ETH trading above 20-day MA indicates sustained bullish momentum

- Record $12 billion unstaking queue demonstrates robust ecosystem activity

- Growing institutional custody solutions and Nasdaq listings enhance accessibility and demand

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Above Key Moving Average

ETH is currently trading at $4,510.01, comfortably above its 20-day moving average of $4,417.22, indicating sustained bullish momentum. The MACD reading of -2.57 suggests some near-term consolidation, though the overall trend remains positive. Robert from BTCC notes that 'ETH's position above the middle Bollinger Band at $4,417.22, with room to approach the upper band at $4,672.75, suggests continued upward potential while maintaining healthy technical foundations.'

Market Sentiment: Institutional Demand and Staking Developments Support ETH Strength

Current market sentiment for ETH remains strongly bullish, driven by significant institutional developments. With $12 billion in unstaking queues indicating robust ecosystem activity and major custody additions for stETH enhancing institutional access, the fundamental backdrop appears solid. Robert from BTCC observes that 'the combination of record staking activity, Nasdaq listing progress for Ether Machine, and expanding institutional custody solutions creates a powerful bullish narrative that complements the technical outlook.'

Factors Influencing ETH's Price

Ethereum Unstaking Queue Hits Record High as $12 Billion Waits to Exit

Ethereum's validator exit queue has surged to unprecedented levels, with over 2.6 million ETH—worth approximately $12 billion—awaiting unstaking. The current wait time stands at 44 days, the longest delay ever recorded. This backlog raises concerns about potential market pressure if stakers decide to liquidate their holdings en masse.

Meanwhile, demand for Ethereum blobs continues to rise, enhancing transaction efficiency across Layer 2 networks. Despite growing competition from these scaling solutions, Ethereum's mainnet remains the backbone of DeFi, generating 87% of Aave's total revenue.

The network's resilience is reflected in its price stability, with ETH holding above $4,500 amid sustained market interest. Analysts remain divided on whether the unstaking wave will trigger a sell-off or simply redistribute liquidity within the ecosystem.

Ethereum Holds Firm at $4,500 Amid Fed Speculation and AI Integration

Ethereum's price stability near $4,500 reflects a confluence of macroeconomic and technological catalysts. The Federal Reserve's impending rate decision looms large, while PayPal's integration of ETH into peer-to-peer services signals growing mainstream adoption.

The Ethereum Foundation's new decentralized AI initiative marks a strategic pivot. Led by Davide Crapis, the team aims to position Ethereum as the settlement layer for autonomous AI agents, with ERC-8004 proposing on-chain identity verification for machine-to-machine transactions.

Retail investors continue monitoring the BullZilla presale, where stage updates and SAFE buying guides drive participation. This dual dynamic—institutional adoption and grassroots interest—highlights Ethereum's unique position at the intersection of finance and Web3 innovation.

Ethereum's Bullish Trajectory and the Rise of Presale Tokens in 2025

Ethereum continues to solidify its position as the backbone of decentralized finance, with analysts projecting a climb to $5,200 by 2026. Institutional adoption and scaling solutions are driving this optimism, though the timeline leaves some investors seeking faster returns.

The presale market is emerging as a hotspot for explosive growth opportunities in 2025. Projects like Moonshot MAGAX are capturing attention by blending meme culture with innovative tokenomics, offering potential gains that dwarf traditional blue-chip cryptocurrencies.

Ether Machine Advances Toward Nasdaq Listing with $2.16B Ethereum Treasury

Ether Machine has filed a draft registration statement on Form S-4 with the SEC, marking a pivotal step in its planned merger with Nasdaq-listed SPAC Dynamix Corporation. The deal, expected to close in Q4, would position Ether Machine as a publicly traded Ethereum treasury management firm.

The $2.16 billion Ethereum reserve underscores the firm's substantial crypto holdings as it prepares for public markets. Shareholders of Dynamix will vote on the transaction at an upcoming extraordinary general meeting, with regulatory approval remaining the final hurdle.

This move reflects growing institutional interest in cryptocurrency-focused investment vehicles. Ether Machine's public debut could set a precedent for other digital asset firms seeking traditional market access while maintaining significant crypto exposure.

ETH Price Holds Above $4.5K as Institutional Demand Signals Strength

Ethereum's price has demonstrated resilience, maintaining its position above $4,500 amid strengthening institutional interest. The cryptocurrency recently achieved an all-time high, with on-chain metrics now turning bullish. The Fund Market Premium (FMP), a key indicator tracking the spread between futures and spot prices, has re-entered positive territory—a signal last seen during November 2024 to January 2025's sustained rally.

Market participants anticipate today's FOMC decision could set the tone for ETH's trajectory through year-end. Analysts note growing consensus around a potential ascent toward $6,800, fueled by renewed institutional participation. The current FMP resurgence, observable since July 2025, mirrors patterns that historically precede significant price appreciation.

Hex Trust Adds Custody Support for stETH, Enhancing Institutional Access to Ethereum Staking

Hex Trust, a leading digital asset custodian, has introduced custody and staking support for stETH, Ethereum's largest liquid staking token. This move allows institutional investors to earn staking rewards without managing validator systems, streamlining access to Ethereum's proof-of-stake ecosystem.

stETH, created via the Lido protocol, dominates Ethereum's liquid staking market. Its integration with Hex Trust's platform enables institutions to securely hold, deploy, and utilize stETH across DeFi applications while maintaining liquidity. The token serves as collateral, trades on lending platforms, and facilitates complex financial strategies.

By combining institutional-grade security with liquid staking flexibility, Hex Trust eliminates infrastructure burdens for clients. The custodial solution mirrors growing demand for turnkey staking products among regulated entities navigating the $50B+ staked ETH market.

SharpLink Gaming Expands Share Buyback as Ethereum Holdings Surge to $3.86B

SharpLink Gaming Inc. ($SBET) shares closed at $16.95 on September 16, marking a 120.7% year-to-date gain. The company has expanded its share repurchase program to nearly 1.94 million shares, signaling strong confidence in its valuation. With no debt and a robust balance sheet, management views buybacks as an optimal way to enhance shareholder value.

The firm's identity is increasingly tied to its Ethereum treasury strategy, which now holds 838,152 ETH worth $3.86 billion—accounting for nearly all of its net asset value. Co-CEO describes Ethereum as 'the cornerstone of the digital asset economy,' drawing comparisons to MicroStrategy's crypto-focused corporate strategy. A significant portion of the ETH holdings are staked, generating additional yield for the company.

Is ETH a good investment?

Based on current technical indicators and market developments, ETH appears to be a compelling investment opportunity. The price holding above $4,500 with strong institutional demand signals underlying strength. Key factors supporting this view include:

| Metric | Value | Interpretation |

|---|---|---|

| Current Price | $4,510.01 | Above key resistance |

| 20-day MA | $4,417.22 | Bullish momentum sustained |

| Bollinger Upper | $4,672.75 | Potential upside target |

| Institutional Holdings | $3.86B+ | Strong institutional support |

Robert from BTCC concludes that 'the convergence of technical strength, growing institutional adoption, and ecosystem development makes ETH a attractive investment for both short-term traders and long-term holders.'